how are rsus taxed at ipo

Are they double trigger vestliquidity event 83i or do employees have to pay taxes in cash as soon as they vest. Carol Nachbaur March 24 2022.

Private Company Stock Grants Recent Sec Filings By Uber And Other Ipo Companies Reveal Plan Design Trends The Mystockoptions Blog

How are RSUs taxed.

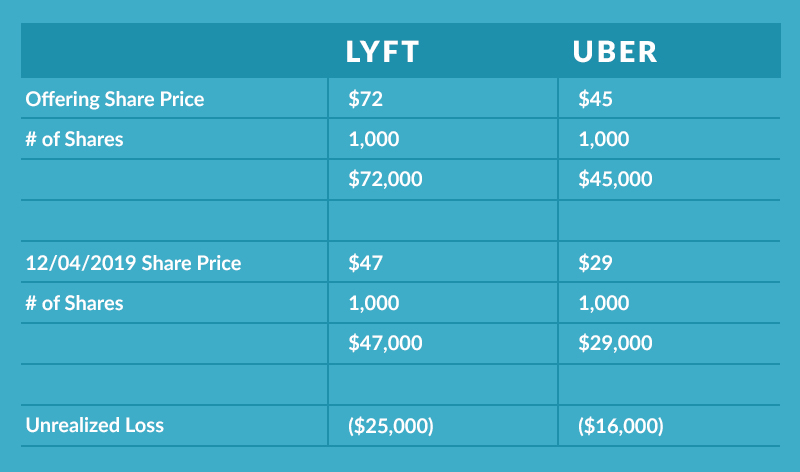

. 72 54 an 18 per share loss. And yes you are able to report capital losses on your taxes but its not pretty. An event such as an IPO merger or acquisition triggers some or all of an RSU grant.

So combined with the quote you gave unless the terms of the RSU specify otherwise. That means every month 22 of your 10 shares in Equity R Us are actually withheld from you for tax purposes. This online calculator allows you to estimate both federal and state taxes due to an IPO or vested RSUs and is especially useful as it takes into account capital gains deductions and existing tax withholdings showing you the additional taxes due that you may need to prepare for.

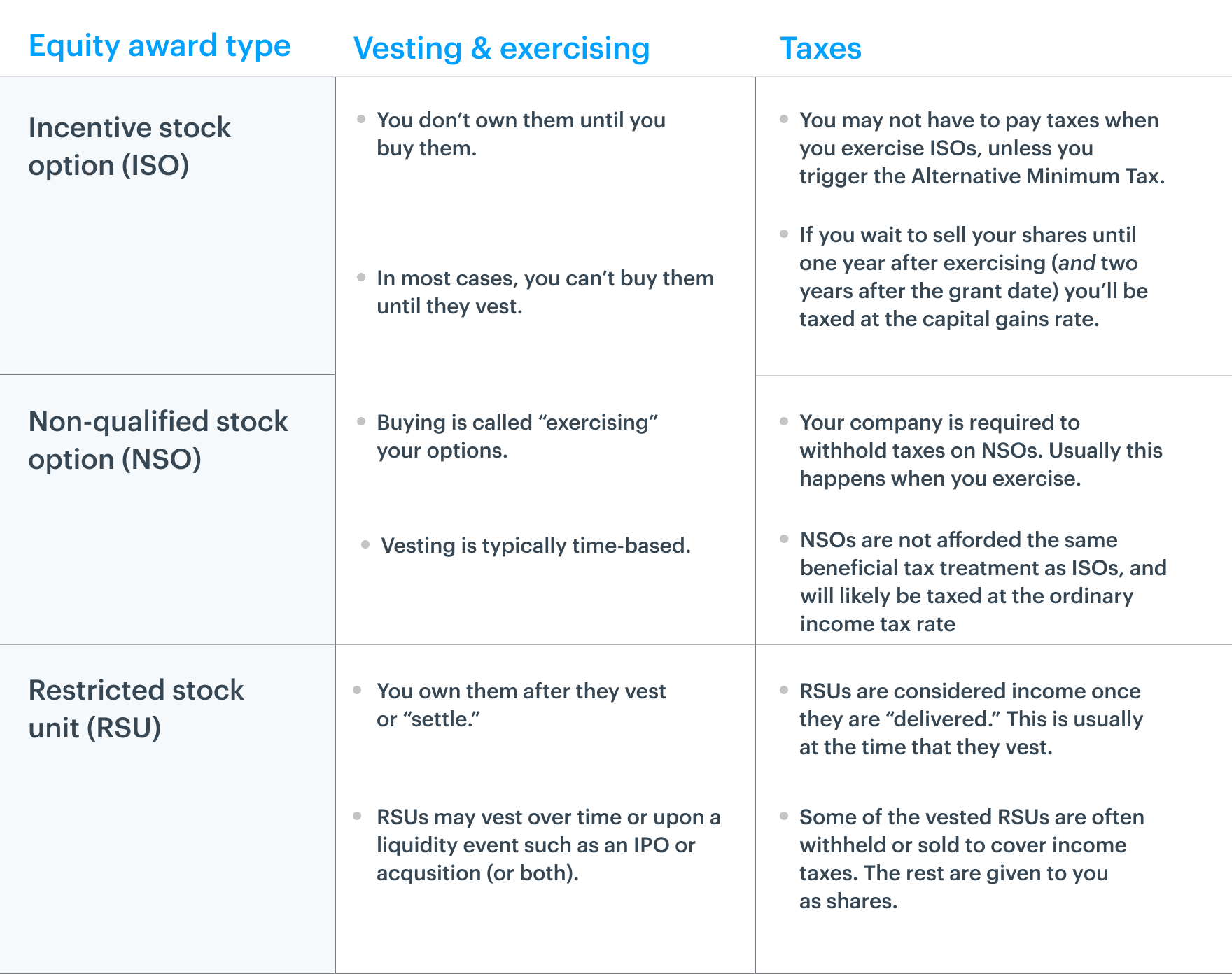

In order to make employee compensation more manageable for tech companies at least a portion of it can. You are granted some RSUs. The three most common forms of equity compensation will include incentive stock options ISOs non-qualified stock options NQSOs and restricted stock units RSUs.

The calculator primarily focuses on Restricted Stock Units RSUs. However I have an opportunity to move to SF for this company and Im unsure of what the tax implications of this move are. Let your company sell sharesRSUs to cover taxes for.

Most early employees will receive pre IPO stock options. With RSUs if 300 shares vest at 10 a share selling yields 3000. You can get a sense of how close your company is to an.

Filing an 83b election with the IRS allows the. How do employees handle income taxes on pre-ipo vested rsus. That said in general the taxable income on an RSU is calculated as the Fair Market Value share price at distribution date -.

They have to pay taxes on a 72 tax basis based on the price that the IPO happened and the shares vested. I work at a pre-IPO tech startup thats been doing fairly well and theres been talk of an upcoming IPO. So please make sure you understand how your RSUs actually worked if you had RSUs in a company that recently went IPO.

Your company has its IPO. As the private company matures and moves toward an IPO or acquisition equity grants tend to shift toward restricted stock. Even if the share price drops to 5 a share you could still make.

In the Facebook RSU structure one potential disadvantage to. Your company has its IPO. Your RSUs vest and become taxable 180 days after Event 2.

As the private company matures and moves toward an IPO or acquisition equity grants tend to shift toward restricted stock units RSUs. Let your company pay your tax withholdings for you - Your company will cover taxes until the lock-up period following an IPO has passed normally 90-180 days. The company will take 22 of your shares sell them at the Fair Market Value of the stock on the.

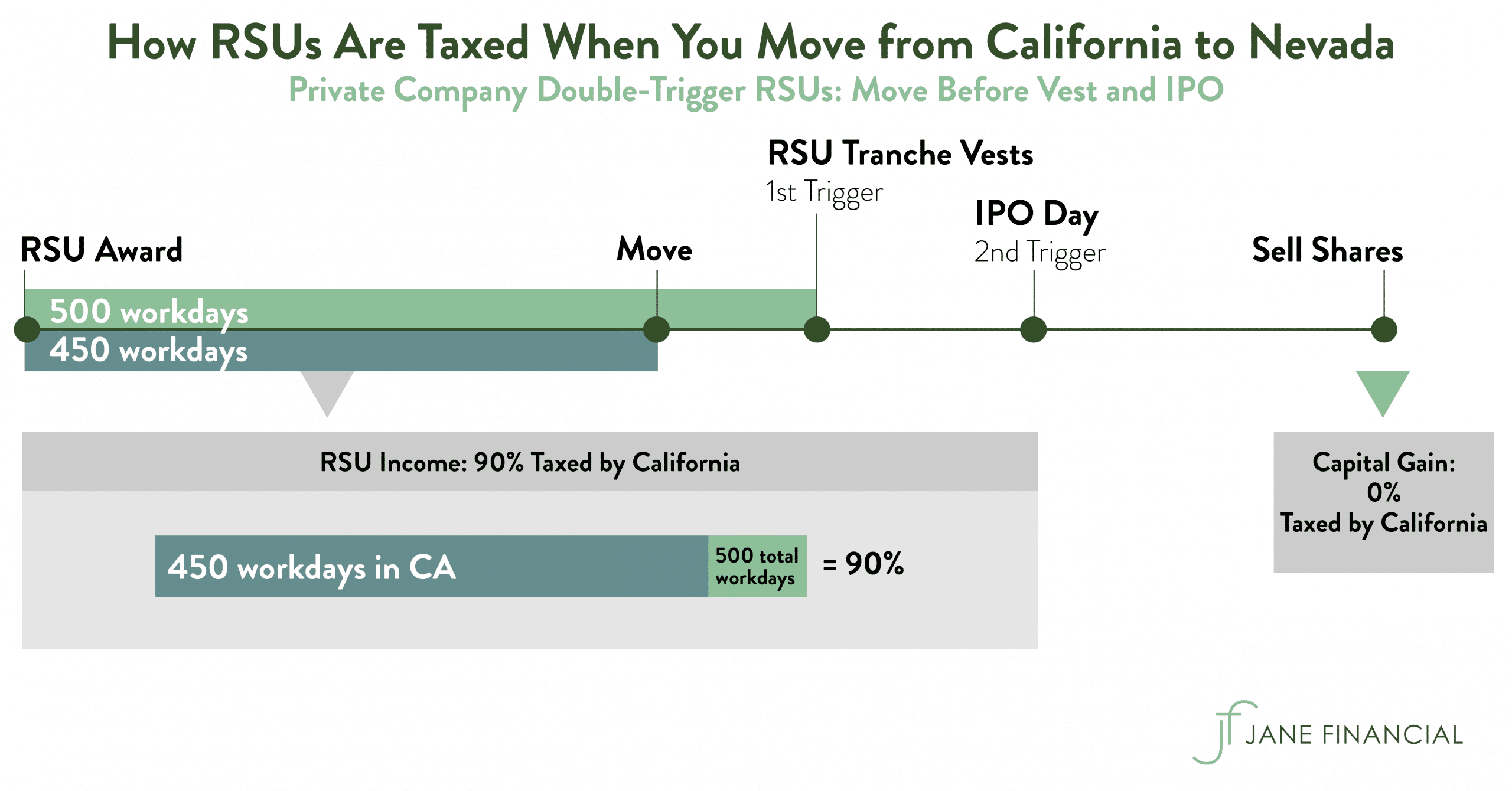

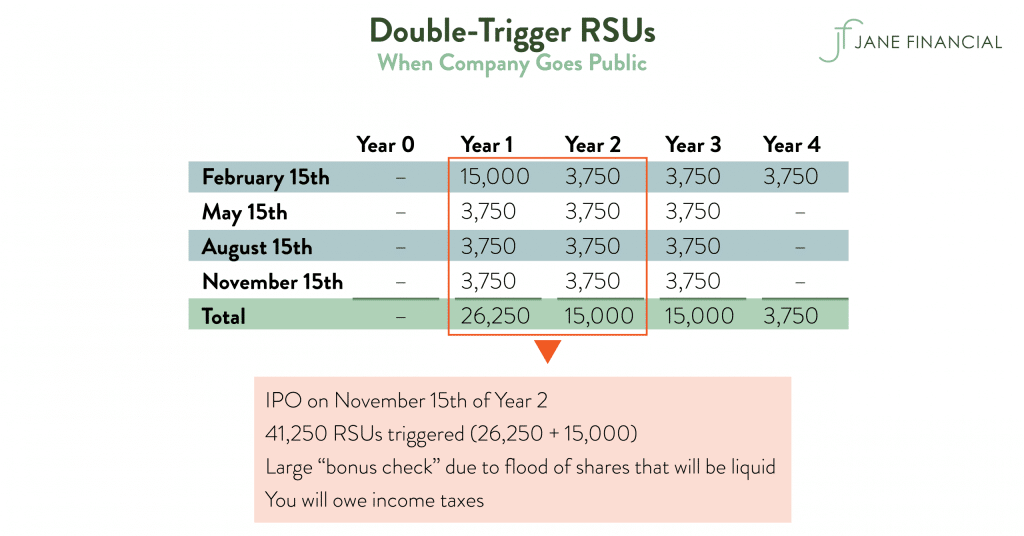

Since RSUs are taxed upon transfer of shares to the participant this is commonly at vest. RSUs at private companies usually have a vesting schedule that has a double trigger. In examples like Airbnb Doordash etc.

RSUs or Restricted Stock Units trigger ordinary income tax when they vest and many RSUs have a vesting schedule thats reliant on an IPO. Since Facebooks IPO other private tech giantsboth unicorns and non-unicornshave followed suit. Taxable income from RSUs is considered supplemental wages.

My company gives double-trigger RSUs which formally vest as income 6 months after the IPO date. Answer 1 of 3. Meanwhile a fateful decision by Uber that could have delighted these people is only aggravating.

RSU Taxes - A tech employees guide to tax on restricted stock units. As tax season begins some of Ubers earliest employees are realizing they had little idea how their stock grants worked and are now grappling with the fallout on their tax bills after last Mays disappointing IPO. Once the liquidity event has occurred the shares vest 180 days later.

That income is subject to mandatory supplemental wage withholding. Be aware of how much investment risk these shares are creating. As with all aspects of taxation specifics will depend on your specific circumstances and should be reviewed with a tax professional.

RSUs will become more prevalent closer to an exit. Expect RSUs In A Later-Stage Private Company. However when they sell theyll only get 54 each.

Theyll charge you a little bit of interest but you dont have to pay anything until after youve seen how the IPO plays out. An IPO triggers taxes for RSUs even if you arent ready to sell the shares. How Private Company RSUs Should Work During an IPO in my opinion In my previous blog post about RSUs in private companies.

Many employees receive restricted stock units RSUs as a part of their compensation particularly in the tech industry. Double-trigger vesting was a major innovation to RSUs. Figure out if you owe taxes now.

Dropbox Lyft Pinterest Uber and others disclosed double-trigger RSU arrangements in SEC filings prior to their IPOs. Currently employers must withhold at least 22 of your RSUs and more if you have excess of 1 million in supplemental income.

What You Need To Know About Restricted Stock Units Rsus

Restricted Stock Units Jane Financial

Year End Planning For Employees With Post Ipo Losses Schmidt

Tech Company Employees With Lots Of Pre Ipo Stock Might Be Wondering About Hedging As A Strategy Hedges Stock Options Option Strategies

Restricted Stock Units Jane Financial

Rsus And Your Company S Ipo Taxes And Other Considerations

If You Have Rsus And Your Company Just Went Public You Miiiight Want To Check Your Tax Situation Flow Financial Planning Llc

Should I Withhold 22 Or 37 On My Rsus When My Company Goes Public Flow Financial Planning Llc

Don T Pay Tax Twice On Rsu Sales Parkworth Wealth Management

Stock Options Rsus From Startup To Ipo Or Acquisition 5 Key Points From Top Financial Advisors

Year End Planning For Employees With Post Ipo Losses Schmidt

Ipo Impact On Equity Grants Of Private Equity Portfolio Companies Jamieson

What You Need To Know About Restricted Stock Units Rsus

Should I Withhold 22 Or 37 On My Rsus When My Company Goes Public Flow Financial Planning Llc

How Equity Holding Employees Can Prepare For An Ipo Carta

Restricted Stock Units Jane Financial

Restricted Stock Units Jane Financial

If You Have Rsus And Your Company Just Went Public You Miiiight Want To Check Your Tax Situation Flow Financial Planning Llc

Avoiding The 1 Million Tax Trap New Section 162 M Regulations Affect Use Of Rsus By Ipo Companies Compensia